Millennials: 3 Ways to Secure Your Future with Insurance

There’s nothing sexy about insurance. In all the movies and popular depictions, anyone concerned with the world of risk assessment and financing is a square who doesn’t really know how to just relax and enjoy life.

Reality is a lot different. Top companies wisely procure all sorts of insurance in case things go bad, and almost all wealthy individuals are insured to the teeth. This realization and desire to protect our wallets is something that usually starts to make sense the older you get. But the irony is that, the younger you are, the better the rates you can often get and the more protected you will be in terms of years in your life.

So Millennials, as they age into maturity and have more to lose, would be wise to shore up their finances and start securing their future with some key policies. The following represent three great ways to secure your bank accounts right now.

1. Saving on Auto Insurance

Teenagers pay the most for auto insurance as a rule. Premiums generally start to drop once you hit your 20s and settle down almost entirely once you reach 30. It doesn’t seem fair — especially to new teen drivers — but insurers have decades of actuarial tables that show quite clearly that youth and accident risk are linked.

Still, no matter your age, there are ways to cut costs. Negotiating to a higher deductible is one strategy to lower premiums. You can also take a defensive driving course, opt for usage-based insurance, or ask for telematic tracking to show you’re better than the average risky driver. To some degree, your auto premiums will remain tied to your age, gender, and especially the place you live. But anyone in any generation can find ways to cut costs. That way, you can enjoy all the benefits of auto coverage with less downside.

2. Getting in Early on Life Insurance

It’s hard to consider your own mortality when you’re young. Teenagers have lower inhibitions and often feel invincible (which is one reason they pay higher auto premiums). This starts to change gradually for most people over time. It really hits hard after marriage, once you have kids, and especially in midlife. But accidents and tragedy can strike at any time.

Even though people under 40 are at much lower risk of many things than senior citizens, being prepared is always a good idea — especially if you have an immediate family that relies on you and your income. The good news is that life insurance is a wonderful way to protect your loved ones in the worst-case scenario, and that premiums are usually very low for those in low-risk groups. If you’re 35 or under, you can get great coverage now and barely notice the cost. The earlier you get on board, the better the deal will be.

3. Realizing the Benefits of Homeowner’s Insurance

A lot of people go their whole life without getting homeowner’s insurance (or its cousin, renter’s insurance). It simply doesn’t get as much attention as auto, life, and health insurance. And, honestly, it isn’t quite at vital as those other categories.

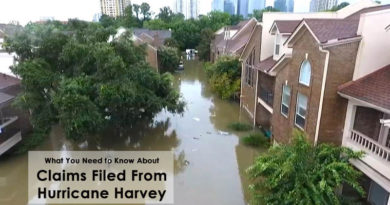

Still, the very reasonable rates mean that everyone should look into it. These days, we all have a lot more technology and other expensive goods lying around our home. So it can make a lot of sense to pay a small sum each month and maintain the peace of mind that you will be protected and able to replace key tools and toys if you’re robbed or hit with another unforeseen event.

Safeguarding Your Financial Life with Insurance

Stability and security are rare commodities in this day and age. What’s here today may be gone tomorrow. That’s why, rather than being a boring field for nerds, insurance is actually one of the most powerful tools anyone can use to protect themselves.

Auto insurance is a requirement but you can get great coverage at a reduced cost if you are smart. Life insurance is so cheap and so beneficial — especially if you get a policy when you’re young. And a homeowner’s policy may not be at the top of your life, but it comes with similar high benefits at a low cost.

Risk is ever present and you can never avoid it entirely. Some people try to pretend that isn’t true. But the smartest people? They realize that nothing is certain and prepare for crisis.